The rapid digitization of the economy has brought about a pressing need for advancements in financial settlement and payment systems. While notable progress has been made, opportunities exist to enhance global settlement capabilities further and eliminate complexities in the payment lifecycle. Recent developments in shared ledger technology and digitally native assets have showcased features that could revolutionize regulated financial networks.

One such groundbreaking concept is the Regulated Liability Network (RLN), which leverages shared ledger technology to enable near real-time transactions with the finality of settlement on a 24/7 basis. RLN operates within the existing two-tier financial system, encompassing both central bank and commercial bank money, and introduces the integration of wholesale central bank digital currency (wCBDC) and commercial bank deposit tokens. This article explores how RLNs are transforming the US payment system modernization landscape, opening new possibilities for seamless and efficient transactions in the regulated financial ecosystem.

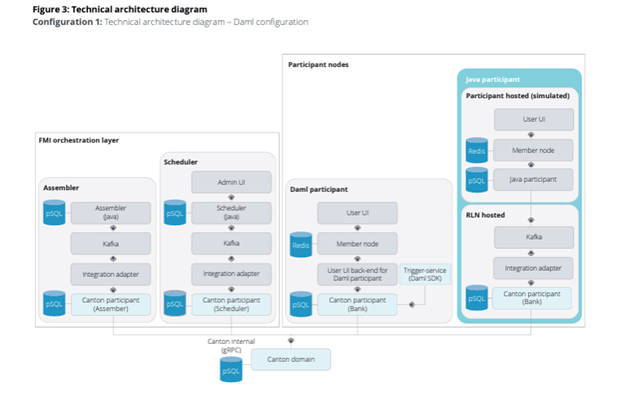

(Original Information Source: https://www.rlnuspoc.org/)

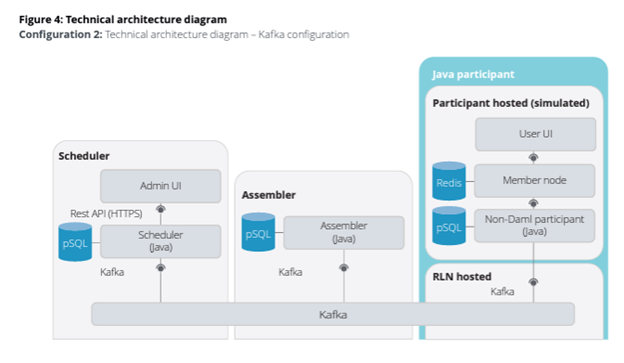

(Original Information Source: https://www.rlnuspoc.org/)

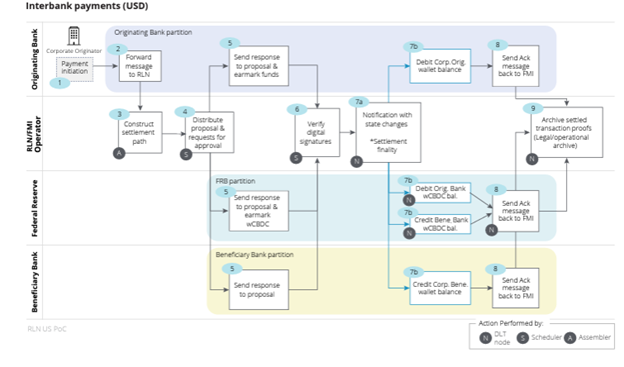

Process flow overview of Interbank payments (USD) (Original Information Source: https://www.rlnuspoc.org/)

Critical Insights: How RLNs Revolutionize the Payment Landscape with Benefits for Banks, Regulators, and Security

RLNs hold great promise for revolutionizing the payment landscape by providing secure, regulated, and efficient settlement capabilities. Banks benefit from reduced disintermediation risks, regulators appreciate the KYC features, and tokenized liabilities enhance security. RLNs address industry demands for improved financial settlement and offer programmability for future expansion into new use cases. RLNs are poised to drive significant advancements in the US payment system, fostering a more seamless and secure financial ecosystem. Let’s explore how:

Banks Embrace RLNs to Mitigate Disintermediation Risks:

RLNs provide banks with a secure and regulated framework for instant settlement, eliminating the potential risk of disintermediation.

By utilizing RLNs, banks can maintain their role as intermediaries in the payment process, ensuring continued involvement and value within the financial ecosystem.

Regulators Find KYC Benefits in RLNs:

RLNs incorporate robust Know Your Customer (KYC) protocols, which regulators appreciate for ensuring compliance and mitigating risks associated with illicit transactions.

Using RLNs allows regulators to maintain oversight and control over the transfer of tokenized liabilities, ensuring adherence to regulatory standards.

Tokenized Liabilities Enhance Security:

Unlike bearer instruments, tokenized liabilities used in RLNs represent the issuer’s liability and cannot be directly transferred to individuals outside the issuer’s KYC boundary.

This characteristic adds an extra layer of security and reduces the risk of unauthorized transfers, providing excellent protection against fraud and illicit activities.

RLNs Address Industry Demands for Improved Financial Settlement:

RLNs respond to the growing need for always-on, global settlement capabilities, meeting the evolving demands of the digitized economy.

Through shared ledger technology, RLNs enable near real-time transactions with the finality of settlement on a 24/7 basis, reducing friction in the payment lifecycle and enhancing operational efficiency.

Future Potential: Programmability and Expanded Use Cases:

RLNs offer programmability, allowing for synchronization of payment processing with complex commercial interactions driven by emerging technologies such as the Internet of Things (IoT) data.

This programmability expands the potential use cases for RLNs beyond traditional payments, paving the way for innovative applications in various sectors, such as supply chain finance and digital asset tokenization.

Bridging the Gap: The RLN Hypothesis and the Convergence of Shared Ledger Technology and the Regulated Financial System

The RLN hypothesis posits that an intersection exists between the advantageous features of shared ledger technology and the positive attributes of the regulated financial system. This notion prompts an in-depth exploration of this convergence, focusing on selected shared ledger features while acknowledging that not all aspects, such as proof-of-work consensus or the creation of digital bearer instruments, may be incorporated. By amalgamating the favorable elements of shared ledger technology with regulated financial services, a productive synthesis emerges, potentially upgrading the sovereign currency system. Through the concept of RLN, a range of beneficial features has been identified, presenting opportunities to modernize the regulated financial services industry.

| Shared Ledger Technology | Regulated Financial Services |

| A common source of truth | Operators licensed by nation-states |

| Orchestrated settlements | Sovereign currency |

| Digital signatures | Promise to pay the depositor on demand |

| Programmability | Two-tier (central and commercial bank) balance sheets |

| Computational universality | Sanctions, KYC, AML, CFT, and other regulations and standards |

(Source: BNY Mellon et al., “Members of the US banking community launch proof of concept for a regulated digital asset settlement platform,” press release, November 15, 2022.

The NYIC’s participation in the PoC is not intended to advance any specific policy outcome nor to signal that the Federal Reserve will make any imminent decisions about the appropriateness or design of tokenized central bank deposits or wCBDC. https://www.newyorkfed.org/aboutthefed/nyic)

Exploring the Potential of RLN: The Convergence of Tokenized Deposits and Shared Ledger Technology in Regulated Financial Services

The RLN proof of concept (PoC) convened a collaborative “working group” consisting of market participants from the public and private sectors. The primary objective was to investigate whether the utilization of shared ledger technology in regulated financial services could offer substantial advantages over conventional payment-system networks. Specifically, the PoC aimed to explore the potential benefits derived from tokenized US dollar central bank and commercial bank deposits, surpassing the capabilities of legacy systems.

The working group for the RLN proof of concept (PoC) comprised various participants from both the public and private sectors. The members included reputable organizations such as BNY Mellon, Citi, HSBC, Mastercard, the New York Innovation Center (NYIC) within the Federal Reserve Bank of New York, PNC, Swift, Truist, TD Bank, US Bank, and Wells Fargo. Their collective expertise and diverse perspectives were instrumental in examining the potential of RLN and its application in regulated financial services.

PoC Scope: Navigating the Wild Waters of USD, Wholesome Tokens, and Regulated Fun!

The Proof of Concept (PoC) was executed over 12 weeks, adhering to specific guidelines and parameters. The PoC’s scope encompassed the following aspects:

- Currency: The focus was solely on the United States Dollar (USD).

- Legal instruments: Wholesale Central Bank Digital Currency (CBDC) and commercial bank deposit tokens were the designated legal instruments examined.

- PoC participants: The participants consisted of regulated entities based in the United States.

- Use cases: The PoC primarily explored domestic interbank and cross-border payment scenarios.

- Blockchain types: Private and permissioned blockchains were utilized throughout the PoC.

- Technology environment: The PoC operated within a sandbox environment, accessible solely through a graphical user interface (GUI).

On the other hand, several elements were explicitly excluded from the PoC scope. These included:

- Currency: multi-currency operations were not within the scope of the PoC.

- Legal instruments: Retail CBDC, cryptocurrencies, stablecoins, e-money tokens, non-monetary instruments (e.g., US Treasuries), and other digital assets were not included.

- PoC participants: Non-US-based regulated institutions and non-regulated institutions were not part of the PoC.

- Use cases: Retail use cases, decentralized finance, indirect participants, and direct involvement of end users (e.g., corporate clients) were not considered.

- Blockchain types: Public and permissionless blockchains were not integrated into the PoC.

- Technology environment: Integration with bank legacy systems and interoperability with other blockchains were not addressed during the PoC.

Use Cases: Unveiling the Potential of RLN in USD Payments

The working group conducted rigorous testing on two use cases to gauge the potential enhancements in USD payments. These use cases aimed to explore the capabilities of RLN and its ability to revolutionize payment processes denominated in USD. Here are the details of the use cases:

Domestic Interbank Payments:

This use case focused on US dollar payment transfers taking place within the United States. Its primary objective was to demonstrate the core functionality of RLN as an efficient payment system. The working group sought to establish seamless transfers of tokenized bank deposits, which were settled using a theoretical wholesale central bank digital currency (wCBDC). By successfully executing this use case, RLN showcased its potential to streamline domestic interbank payments, paving the way for enhanced transaction efficiency within the US financial system.

Cross-Border Payments in USD:

Expanding beyond domestic boundaries, this use case delved into US dollar payment transfers outside the United States. The primary objective was to assess the RLN design’s ability to enhance the experience of global users relying on USD as an international settlement currency. By exploring the intricacies of cross-border payments, the working group aimed to identify opportunities for RLN to deliver significant upgrades, such as improved speed, efficiency, and transparency, in global USD transactions. This use case demonstrated the potential of RLN to strengthen the position of USD as a trusted and convenient international settlement currency.

Significance of the Use Cases:

The use cases played a crucial role in showcasing the transformative power of RLN in the realm of USD payments. Through the domestic interbank use case, RLN demonstrated its potential to optimize interbank payment transfers within the United States, paving the way for faster, more secure, and cost-effective transactions. The cross-border use case further highlighted RLN’s capacity to address pain points in international USD payments, offering improved efficiency and seamless user experiences across borders. By successfully addressing these use cases, RLN showcased its ability to drive advancements in the USD payment landscape, benefiting financial institutions, businesses, and individuals.

The Productive Synthesis: RLN’s Potential Unveiled through PoC Findings

The Proof of Concept (PoC) successfully uncovered the possibility of a fruitful fusion between the desirable elements of shared ledger technology and the positive attributes of regulated financial services. Let’s explore the key findings from each workstream:

Business Workstream:

The business workstream highlighted the potential for significant improvements in global payments denominated in USD through the implementation of a network like RLN. Leveraging shared ledger technology, tokenized money, and operating 24/7, RLN demonstrated the feasibility of creating a global, near real-time, 24/7 dollar payment system. This system could greatly benefit global users relying on USD as an international payment currency, potentially leading to a progression from real-time domestic USD payments to a global, real-time USD payments ecosystem. Moreover, the workstream recommended further exploration of alternative models and technologies beyond the scope of the PoC to enhance the design space.

Legal Workstream:

The legal analysis conducted within the PoC concluded that RLN could be delivered within existing legal frameworks. No significant issues preventing the creation of RLN, as envisioned in the PoC, were identified. RLN has the potential to provide settlement finality at a specific point. If a technologically neutral regulatory stance were adopted, the use of shared ledger technology, including tokens, for recording and updating ownership of central bank and commercial bank deposits would not fundamentally change the legal treatment of these deposit liabilities.

Technical Workstream:

The technical workstream demonstrated the technical feasibility of implementing RLN’s functionality using shared ledger technology. The sandbox environment showcased the ability to orchestrate seamless movements of central bank money and commercial bank money among participants in an “atomic” manner, ensuring instantaneous and irrevocable transfers of value while maintaining a shared state. Transactions remained confidential and shared only among involved participants, preserving privacy across the network. The RLN PoC successfully demonstrated the potential to achieve many beneficial features in shared ledger technology and traditional finance through the RLN design construct.

The PoC’s findings collectively emphasize the exciting potential of RLN to revolutionize the payment landscape. By combining the strengths of shared ledger technology and regulated financial services, RLN offers a path to enhanced global payments, regulatory compliance, settlement finality, and operational efficiency. These insights serve as a foundation for further exploration and development, heralding a new era in the evolution of modern financial systems.

Avenues Ahead: RLN’s Potential for Global Instant Cross-Border Payments in USD

The working group’s findings indicate that RLN presents a promising design for a network capable of enabling instant settlement for cross-border US dollar payments on a global scale. This groundbreaking development will be delivered through the regulated financial system, revolutionizing the efficiency and speed of international transactions. As the industry looks towards the future, a feasibility study should be conducted to explore RLN further, along with alternative designs, aiming to establish a global instant-dollar payment system. This potential breakthrough paves the way for enhanced financial interactions across borders, fueling economic growth and facilitating seamless cross-border trade.

Future RLN Phases: Unlocking New Possibilities

Looking ahead, RLN holds tremendous potential for further advancements. Future considerations involve expanding beyond single-currency operations and exploring multi-asset and multi-currency capabilities. This expansion would broaden the range of regulated financial instruments represented and settled on the RLN system. By embracing these future RLN phases, the financial ecosystem can unlock new avenues for innovation, driving the adoption of advanced technologies and fostering a more dynamic and inclusive global financial landscape.

Future Public-Private Research Collaboration: Uniting Forces for Financial Upgrades

The RLN PoC highlights the significant advantages of bridging the gap between the public and private sectors, pooling their expertise to explore shared ledger technology’s potential to upgrade the regulated financial system. The two-tier public-private financial system is an integrated whole, providing vital services to citizens and the economy. Collaborative efforts between the public and private sectors offer a robust framework to delve deeper into the application of emerging technologies within the sovereign currency system. As research and development continue, sustained public-private collaboration will be essential to foster innovation, enhance financial infrastructure, and ensure the continued resilience and efficiency of the global financial ecosystem.

Wrapping Up: RLNs Revolutionizing the US Payment Landscape

In transforming the US payment landscape, the Proof of Concept (PoC) undertaken by the working group played a crucial role in unraveling the immense potential of Regulated Liability Networks (RLNs). Although conducted within the confines of a sandbox environment, the PoC provided valuable insights into the technical feasibility and functional capabilities of RLNs.

The technical workstream assessed the feasibility of RLN’s operation on shared ledger technology and revealed that a shared ledger platform could serve as a robust foundation for orchestrating settlements among participating institutions. While the PoC did not delve into identifying the optimal architecture, the presence of a theoretical wholesale central bank digital currency (wCBDC) alongside deposit tokens issued by commercial banks enabled a seamless coupling of settlement with customer payments. This tight integration offered a compelling advantage over traditional messaging-based payment systems, allowing for greater parallelism in workflow processes.

Moreover, the programmability features inherent in RLNs unlock an array of innovation opportunities. While the PoC limited programmability, it is clear that RLNs hold the potential to drive further advancements in payment systems by enabling enhanced customization and synchronization of payment processing with complex commercial interactions. This capability opens doors to leveraging emerging technologies like the Internet of Things (IoT) and expanding the scope of RLNs beyond their initial use cases.

As RLNs mature and evolve, the insights gained from the PoC lay a strong foundation for future developments. The transformation of the US payment landscape through RLNs promises greater operational efficiency, real-time transactions, improved cross-border payments, and enhanced regulatory compliance. By bridging the gap between tokens and liability, RLNs are revolutionizing how payments are conducted and establishing a new paradigm in the US financial ecosystem.

The journey towards RLNs’ widespread adoption and implementation is still ongoing. Still, the enthusiasm and potential showcased by the PoC findings underscore the transformative impact that RLNs can have on the US payment landscape. As financial institutions, regulators, and technology providers collaborate to shape the future of RLNs, we can look forward to a more innovative, efficient, and inclusive payment ecosystem that empowers businesses and individuals alike.

Looking ahead, RLNs hold promising future possibilities. With further exploration and development, RLNs could expand their operations beyond single-currency transactions and delve into multi-asset and multi-currency operations. Imagine a payment ecosystem where various regulated financial instruments can be represented and settled seamlessly on the RLN system, creating a unified and efficient global financial infrastructure.

The collaborative effort between the public and private sectors during the RLN PoC demonstrates the power of shared exploration and innovation. By bridging the gap between traditional financial institutions and cutting-edge technology providers, RLNs have the potential to transform the sovereign currency system, enhance customer experiences, and drive economic growth.

RLNs are set to revolutionize the US payment landscape, propelling us into a future where instant, secure, and efficient transactions are the norm. This transformative shift holds significant implications for businesses, financial institutions, and individuals alike. As RLNs continue to evolve and gain traction, staying abreast of the latest developments and leveraging their benefits will be key to staying ahead in this dynamic financial landscape. The future of payments is at our doorstep, and RLNs are leading the way. Get ready to revolutionize your financial operations, enhance your customer experiences, and unlock new opportunities in the ever-evolving world of payments. The time for RLNs is now!

MSys Technologies is a formidable force within the fintech realm. With a comprehensive suite of services encompassing banking payments, embedded finance, personal financial management, lending, and much more, MSys serves as the true catalyst for success in the financial industry. MSys empowers businesses with agility, accuracy, availability, and unprecedented speed by seamlessly integrating cutting-edge technologies like APIs, mobile applications, and web-based solutions.

MSys does more than just being a technology provider; it is a strategic partner driven by technological ingenuity and a customer-centric approach. By embracing the “Customer Intimacy” model, MSys goes beyond mere transactional relationships to forge deep connections with clients, delivering personalized experiences and building unwavering trust.

With a team of over 250 skilled engineers, MSys offers full-stack fintech expertise that ensures your financial services business operates at peak efficiency while reducing costs by up to 45%. From comprehensive testing services to CI/CD-powered QA automation solutions, MSys supports your business at every step, providing technical assistance, data analysis, and more.

In the ever-evolving world of fintech, MSys is the knight in shining armor, equipping businesses with the mighty hammer of transformative solutions. Together, we conquer the hurdles of the financial services landscape, optimizing your endeavors and propelling your business to new heights.

So, are you ready to unleash the full potential of your business? Join forces with MSys and let us be your trusted partner, guiding you through the intricacies of the fintech realm. Embrace the power of MSys and embark on a journey of innovation, growth, and success. Contact us today and witness the MSys difference – the ultimate ally in your financial services conquest!